Bahrain

Company Formation

Excellent

Based on 423 reviews

- 100% foreign ownership

- Available investor visa

- For non-citizen and freelancers

- Our 100% success rate

Benefit

OFFSHORE COMPANY REGISTRATION IN BAHRAIN

- Highly developed and well-regulated financial sector

- Allowed 100% ownership for non-citizens

- No corporate and personal taxes

- Investor and family visa with nominal fee

- 5 Free Trade Agreements (FTA) signed with 22 countries

- No restrictions on repatriation of profits and no exchange controls

- Free-holding of properties for foreigners

- Reasonable cost of business maintenance in Bahrain

- No public records of registers of company members

- Government support for startup from 2 to 4 years

With Limited Liability (WLL) Company Features

Company formation in 10-14 business days

Nominal requirement on paid-up capital

Need to file annual audit reports

Simple registration with only one director

Need to pay nominal annual renewal charges

Commercial office required for company formation

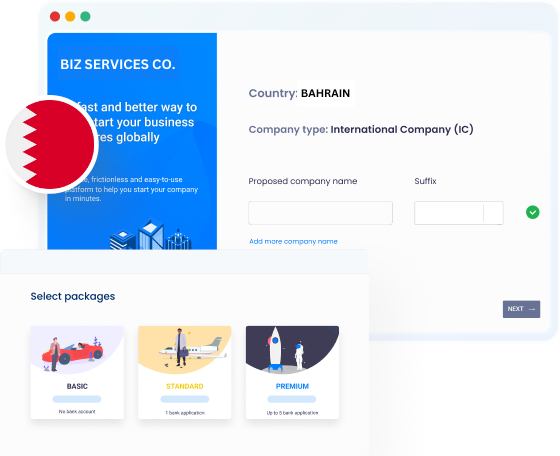

Bahrain Company Formation Packages

BASIC

STANDARD

PREMIUM

Refund Guarantee

We refund your money in full for services that we cannot deliver.

Read our policy

BAHRAIN

Company Incorporation Process

Create your orders

Enter our online order platform for easy onboarding experience and tailor your orders. We have different packages and additional services that suit your goals. All information filled in is secured over 256-bit encrypted line.

Collect and verify KYC documents

Once we’ve received your payment, our customer service will contact you to process the neccessary paperwork. We’ll guide you to properly prepare documents for incorporation via KYC online form. You can also access our digital Client Portal to proceed with the incorporation steps and keep track of the process anytime, anywhere.

Make payment

You can settle payment for services via flexible payment options including debit/credit card of Visa, Master, Amex or Bank Transfer. After you complete payments, we will provide you a checklist of required information for [country] company registration.

Finish the company registration

The electronic documents are ready after 1-2 working days of company formation, and it takes 3-7 days for courier the original kit.

Need More Help To Set Up A Business In BAHRAIN?

Just get in touch with us. We typically response within 2 hrs.

Frequently Asked Questions

- Company formation

- Corporate textation

- Annual Requirements

- Others

Yes, you can setup a company in Bahrain for services and manufacturing businesses as a 100% foreign owner without taking citizen as shareholder. For some business activities, there is still Bahraini citizen required as shareholder. As per new legislation, only one (1) Bahraini share (0.01%) is required for the trade sector and 51% for construction businesses.

A typical company can be formed maximum in 20 to 30 Business days and can be completed early if the application moves smoothly and depend on the package you chose.

To start a business in Bahrain, reserve your business name, draft and notarize necessary documents, deposit capital, submit the application, await approval, complete registration, obtain licenses, register for taxes, open a bank account, and ensure ongoing compliance.

The following documents are required for setting up a company in Bahrain and you can contact us to make it easy and fast.

- A copy of passport

- Virtual / Physical Address

- 6 months’ bank statement to open a bank account for capital deposit

After company formation in Bahrain, each shareholder will get a “Businessman/Investor” resident permit and resident permits for their dependents (Spouse and Children). Initially you can avail 2 work-permits for your employees. Later you can increase the work-permits by providing the workload documents.

The legals form of the company will be with limited liability (WLL), its same as a Limited Liability company (LLC) in other countries.

There is no corporate tax in Bahrain

Yes, VAT (value added tax) is imposed on goods and services at a uniform rate of 10%. Financial and insurance services and real estate businesses are VAT exempt. No VAT is levied on food items and education. Oil and gas explorations are also free of VAT.

Every company in Bahrain is required to submit the annual audit report and renew the commercial registration by paying a nominal fee.

Business operation

A Bahrain ICC company can be registered in the following types:

- Company limited by shares

- Company limited by guarantee

- Unlimited company

- Company limited by shares is the most popular one among others.

A RAK ICC company can adapt multiple business objectives such as follows:

- International business company facilitating global investment and trade;

- Holding company;

- SPV holding real estates or other assets;

- Joint venture;

- Wealth management and asset protection.

Company directors/shareholders

A company should, at all times have at least one director and one shareholder. Company members could be of any nationality and can be body corporate given that one natural director is available.

Registers of company directors and members have to be filed with the Registrar for registration. However, particulars related to company members are not disclosed to the public.

Share capital

The share capital has no required minimum registered amount and can be expressed in any currency.

Registered or ordinary shares, shares with preferential rights related to voting, redemption or dividend, non-voting shares, par value and non-par value shares. Bearer shares are not permitted.